Governance

Corporate Governance

This section introduces our initiatives regarding corporate governance.

We are striving to build a sound governance system in order to achieve highly transparent management and live up to the trust of our stakeholders.

- Information current as of July 1, 2024.

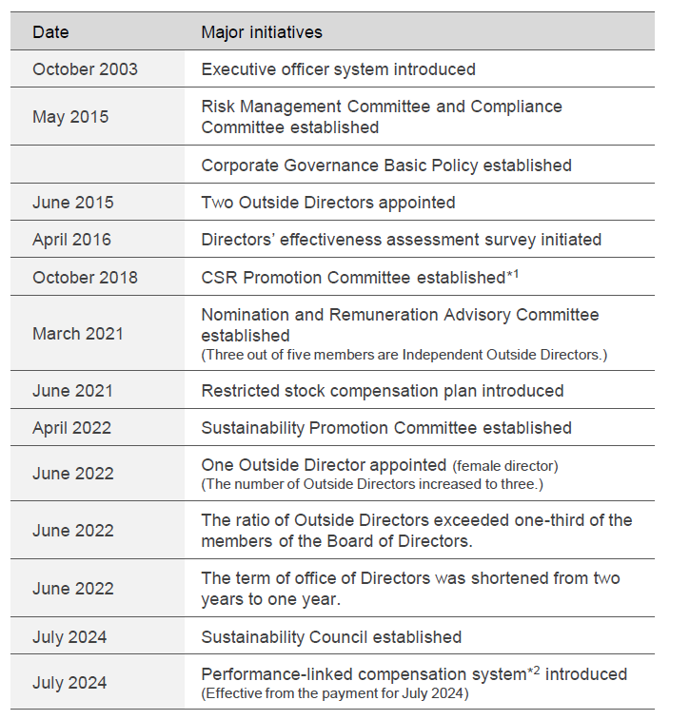

Major initiatives to date to strengthen corporate governance

- Renamed the SDGs Promotion Committee in March 2021

- Compensation, etc. for Directors” consists of base salary, position-based salary and a performance-linked portion* as basic compensation (monetary compensation) and restricted stock as basic compensation (stock-based compensation). “Compensation, etc. for Outside Directors” consists of only base salary as basic compensation (monetary compensation), taking into account their responsibilities, duties, etc.

- With regard to the “performance-linked portion,” the compensation system was changed to one based on the indicators of “net sales,” “operating profit,” and “return on equity” effective from the payment for July 2024.

After the change, the approximate ratio of a fixed portion of basic compensation (monetary compensation), a performance-linked portion of basic compensation (monetary compensation), and basic compensation (stock-based compensation) was set to be 60:20:20 in the case where the performance indicators are 100% achieved. However, the payment rate of the performance-linked portion to be actually paid will vary as it fluctuates according to the Group’s performance.

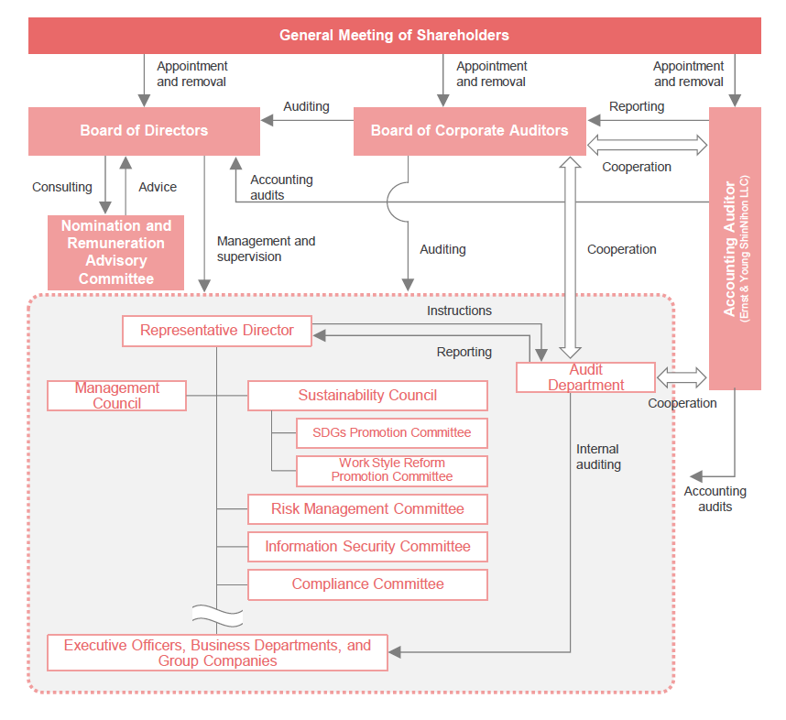

Strengthening corporate governance

The Mitsuboshi Belting Group is a company with a Board of Corporate Auditors that has in place a Board of Directors comprising eight Directors, three of whom are Outside Directors, and a Board of Corporate Auditors comprising three Corporate Auditors, two of whom are Outside Corporate Auditors. The Board of Directors makes decisions on important matters and supervises the execution of business by Directors. The Management Council meets prior to a Board of Directors meeting in order to ensure sufficient advance discussions regarding important matters.

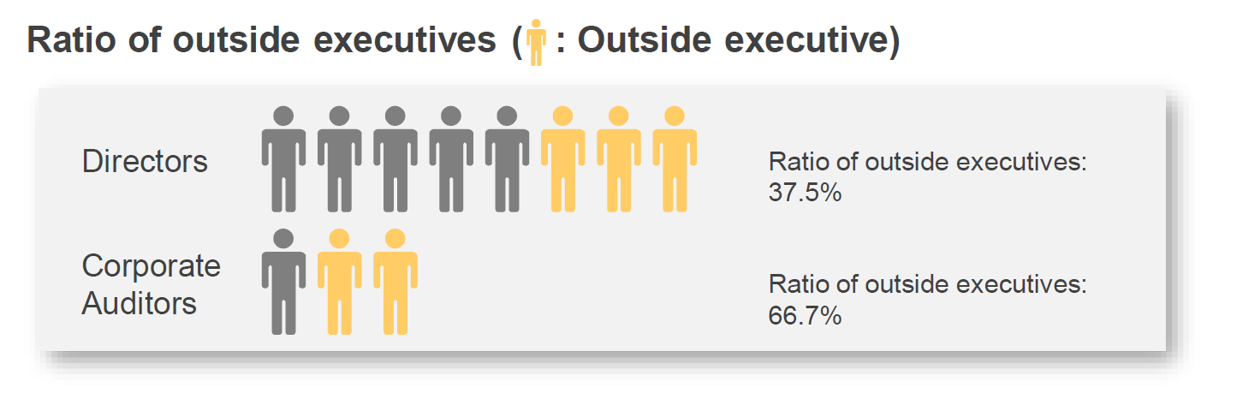

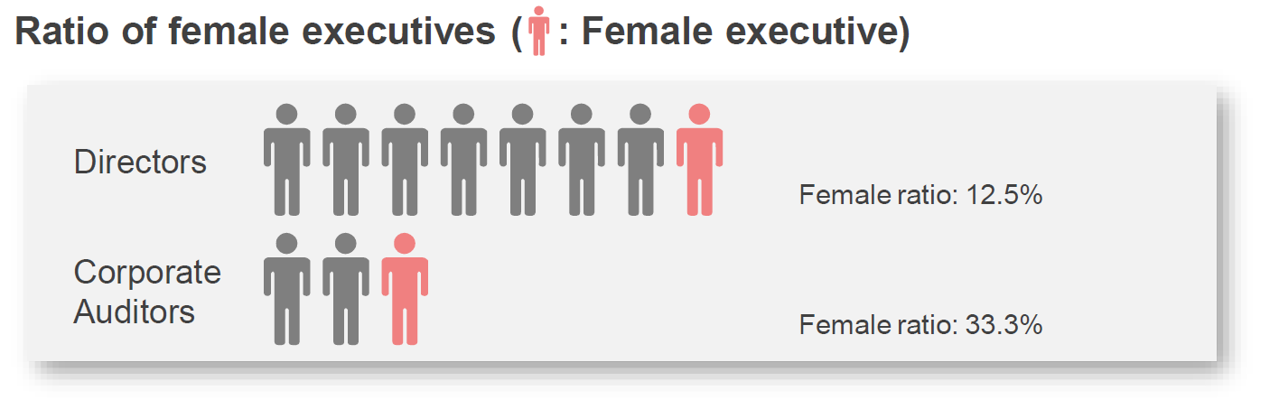

In addition, we have established the Nomination and Remuneration Advisory Committee (a voluntary advisory committee consisting of at least three members, the majority of whom are Independent Outside Directors) with the aim of enhancing the functional independence, objectivity, and accountability of the Board of Directors concerning matters such as the appointment, removal, and remuneration of management team members. Furthermore, a restricted stock compensation plan has been introduced with the aim of sharing profits with our shareholders and improving corporate value over a long period of time. In this way, we are committed to enhancing and improving corporate governance. The ratios of outside and female executives among Directors and Corporate Auditors are as shown below.

Our view on the appointment of Directors

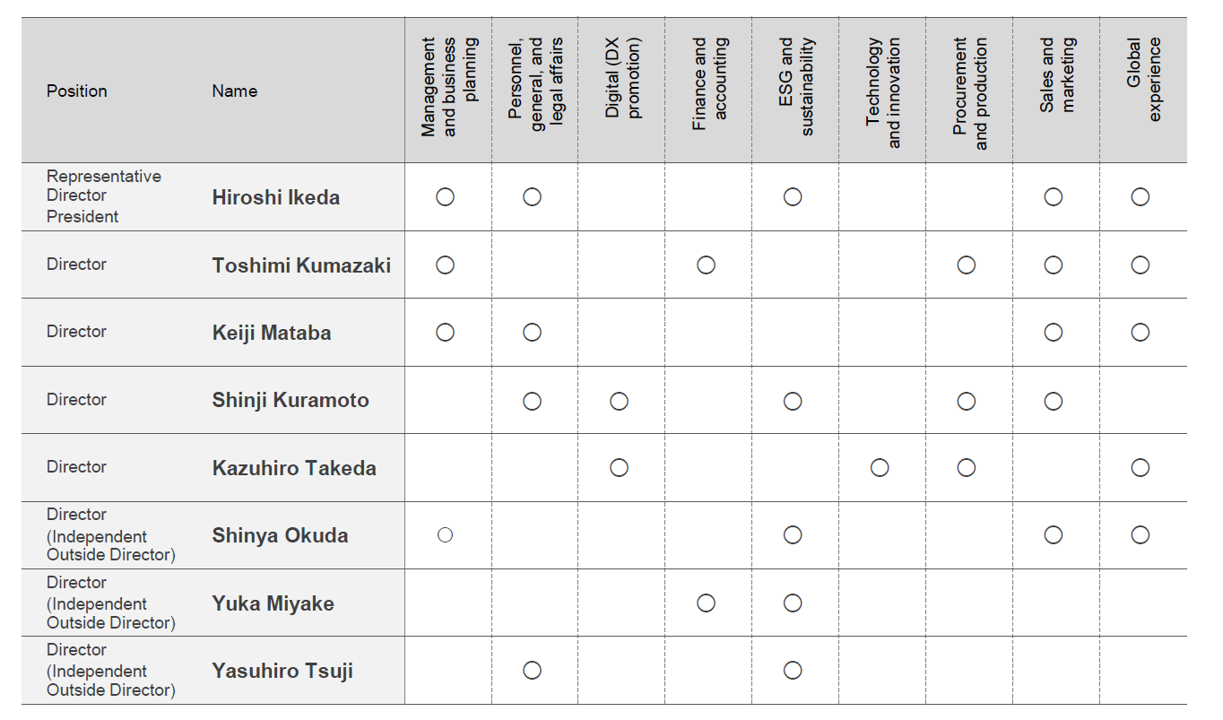

Regarding the appointment of senior management team members and the nomination of director candidates, we examine the candidates from various aspects, including diverse experience, knowledge, and competence suitable for promoting further enhancement of the corporate value of the Mitsuboshi Belting Group, as well as qualities such as a broad perspective and the ability to take action and lead.

Skill matrix table for Directors (a list of knowledge, experience, abilities, etc.)

Roles expected of Independent Outside Directors

- Possesses a high level of insight, extensive practical experience, and experience in leadership roles in areas such as corporatemanagement, international business, financial affairs and accounting, banking and finance, regulatory compliance, legal affairs,public administration, academic studies and research, risk management, human resource development and education, and IT and digital

- Has abilities such as understanding the entire Group from a bird’s-eye view and grasping essential issues and risks, and can be expected to contribute to frank, active, and constructive deliberations at meetings of the Board of Directors and other occasions

- Is capable of objectively supervising and making decisions on business management and providing advice and support for the company’s sustainable growth from a practical perspective based on his/her extensive experience in corporate management and specialized fields

- Meets the requirements for Outside Directors under Japan’s Companies Act and the independence standard set by the Tokyo StockExchange

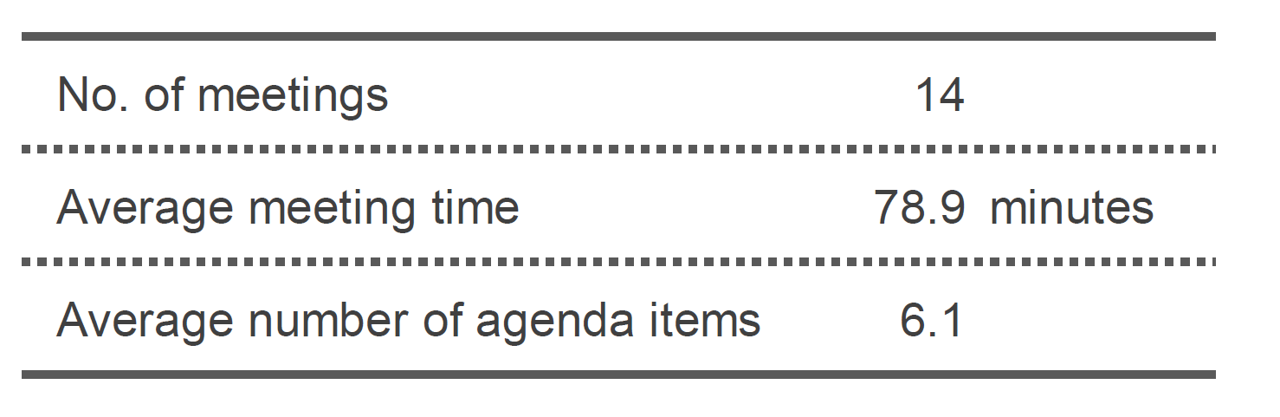

Operation status of the Board of Directors

In accordance with relevant laws, the articles of incorporation, and the regulations for the Board of Directors, our Board members deliberate on and resolve matters related to our basic management policy and investments and other matters such as the execution of important business operations (including disposal and acceptance of transfer of important assets, borrowing in large amounts, establishment and change of important organizations, and appointment and removal of important employees). The Board also reports on the status of Directors’ execution of duties as well as the status of other important business operations.

In FY2023, in addition to regular agenda items (matters for resolution and reporting), the Board of Directors deliberated on matters related to the 2024 Mid-Term Business Plan, corporate governance (such as appointment and remuneration of Directors and succession planning of the Representative Director and Directors), investments (related to production, logistics, and businesses), and sustainability (such as external disclosure reports).

Regarding the operation of the Board of Directors, briefing sessions for Outside Directors are held prior to Board meetings in order to ensure the effectiveness of the Board and adequate deliberation and discussion within the limited time available (13 preliminary briefing sessions held in FY2023).

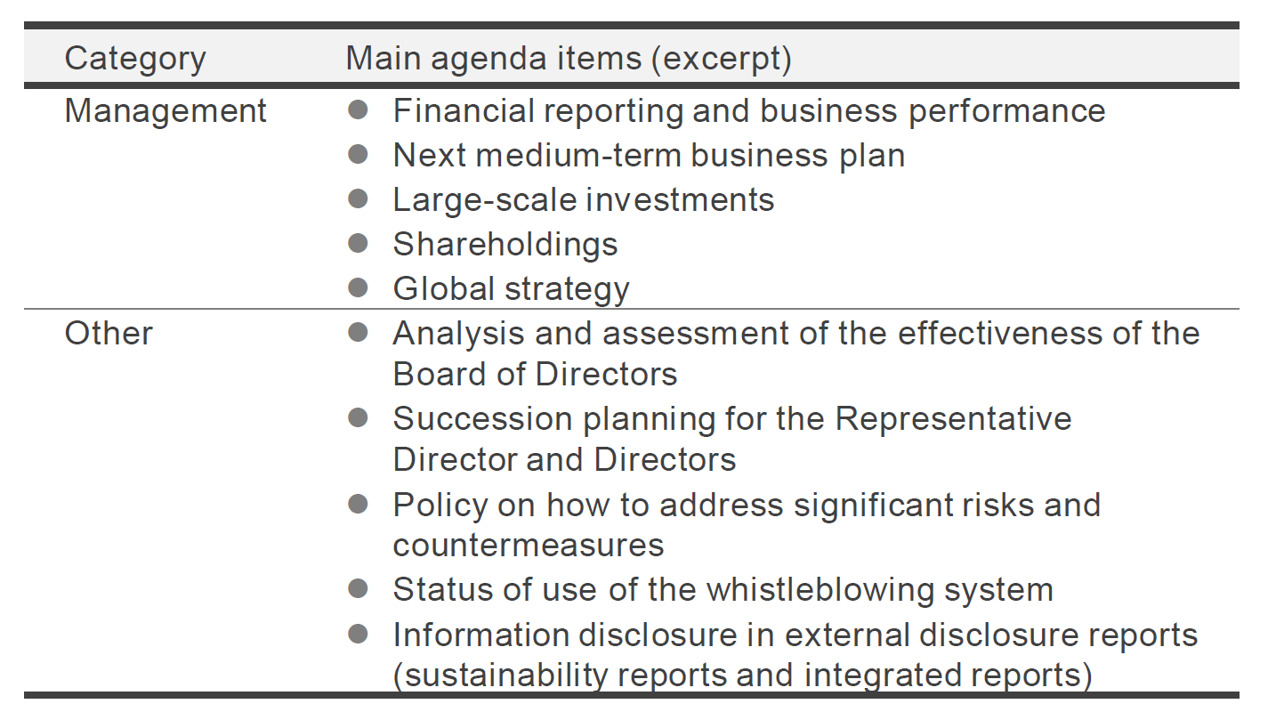

List of main agenda items at Board of Directors meetings (excerpt):Operation status of the Nomination and Remuneration Advisory Committee

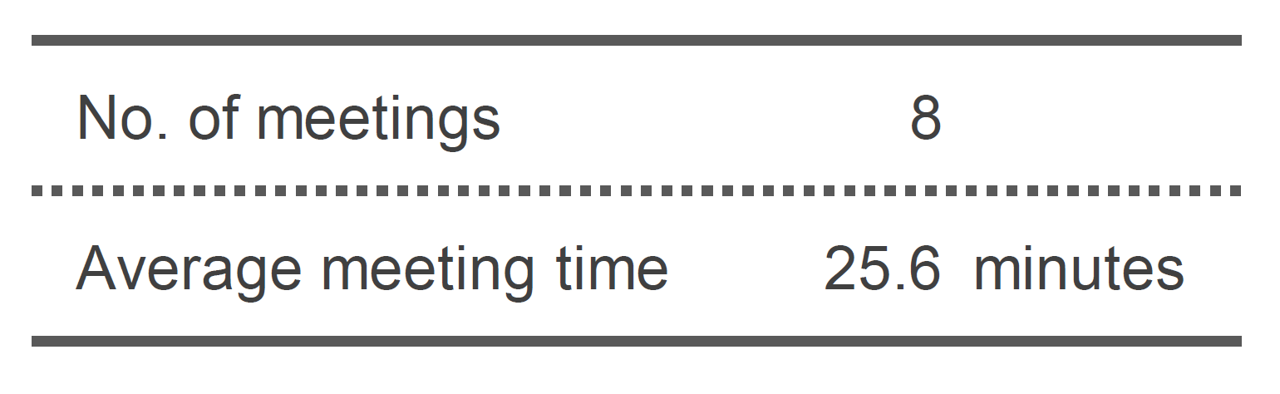

We have established the Nomination and Remuneration Advisory Committee as a voluntary system (consisting of at least three members, the majority of whom are Independent Outside Directors) with the aim of enhancing the functional independence, objectivity, and accountability of the Board of Directors concerning matters such as the appointment, removal, and remuneration of management team members.

The Committee deliberates and make decisions (in response to inquiries by the Board of Directors) on matters such as policies and procedures related to the nomination of director candidates, the appointment and removal of senior management team members, and the determination of succession planning (for normal times and emergencies) for the Representative Director and Directors and of Directors’ remunerations, in accordance with the Nomination and Remuneration Advisory Committee Regulations.

In FY2023, the Committee interviewed 10 executive officers who are candidates for next-generation leaders (approximately 30 minutes each) to confirm their respective capability development and career plans, with the aim of building a system that will support our sustainable growth in the future. Based on the results of these interviews, the Committee assesses the aptitudes of the next-generation leaders or deliberates on their development policies.

Effectiveness assessment of the Board of Directors

As part of our ongoing efforts to continually maintain and improve the functions of the Board of Directors, we assess the effectiveness of the Board of Directors as a whole each year.

To further ensure the effectiveness of the Board of Directors and improve its functions, we have attendees (Directors and Corporate Auditors) of the Board of Directors meetings complete a self-assessment questionnaire (written survey) annually regarding matters related to the Board of Directors (including provision of information, items submitted to the Board, deliberation and supervision, effectiveness of individual members of the Board of Directors and of the Board as a whole, contents to be disclosed in reports on corporate governance, and opinions, proposals and requests for improvement from Directors and Corporate Auditors) in order to identify issues and areas for improvement and enhance the effectiveness of the Board of Directors.

As for the assessment for FY2023, we conducted the above-mentioned questionnaire from March to April 2024. At a subsequent Board of Directors meeting, we reviewed and analyzed the results and also exchanged opinions and held discussions regarding “how to provide more information to the Board of Directors, etc.,” especially for which there were many opinions and requests from Directors and Corporate Auditors. In light of these results, it was determined, at the Board of Directors meeting held in June of the same year, that “the current Board of Directors is functioning well and the effectiveness of the Board as a whole is ensured.”

Status of dialogue with shareholders and investors

We have established a policy for constructive dialogue with shareholders and taken proactive steps to realize constructive dialogue. The opinions, etc. of shareholders obtained through dialogue are reported to Directors, management team members, and relevant internal departments as necessary to share and utilize the information.

In FY2023, we held a total of 66 financial results briefings and individual dialogues for institutional investors and analysts, where we received a great deal of useful feedback. We will continue to deepen our relationship of trust with shareholders through transparent information disclosure and sincere dialogue.