Governance

Corporate Governance

Corporate Governance

Our basic view on corporate governance

The Mitsuboshi Belting Group considers the enhancement of corporate governance one of its paramount management priorities in order to secure the trust of its shareholders and fulfill its corporate social responsibilities. Based on this Corporate Philosophy, we will strive to improve our business performance by promptly and flexibly adapting to changes in the business environment and markets. In addition, to maintain and improve management efficiency and transparency, we will engage in initiatives, such as strengthening the function to oversee our business management and internal control systems, in accordance with the basic policies below, thereby ensuring enhanced corporate governance.

Basic Policy

The Company strives to respect its shareholders’ rights and secure its shareholders’ equality.

- The Company strives to respect the rights and positions of its stakeholders (including shareholders, customers, employees, and communities), and work properly in harmony with them.

- The Company strives to disclose its corporate information in a timely and proper manner, and thereby secure transparency and fairness.

- The Company strives to ensure that the Board of Directors and other parties properly fulfill their roles and responsibilities, in light of the Company’s fiduciary responsibility and accountability to its shareholders.

- The Company strives to have constructive dialogues with its shareholders.

Strengthening corporate governance

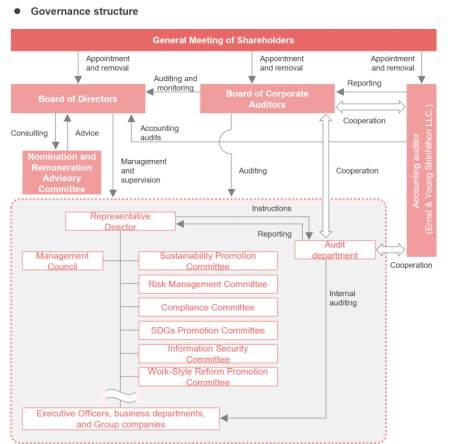

We are a “a Company with a Board of Company Auditors,” and have in place the Board of Directors comprising eight members, three of whom are outside directors, and the Board of Corporate Auditors, which consists of four members including three outside corporate auditors. The Board of Directors makes decisions on important matters and oversees the execution of business by directors. Regarding important matters, the Management Council meets prior to a Board of Directors meeting in order to ensure sufficient discussions.

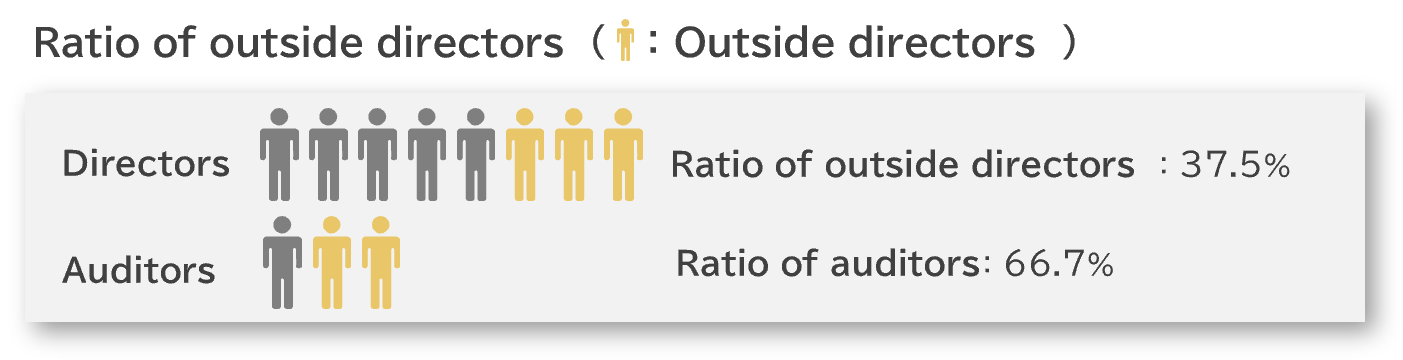

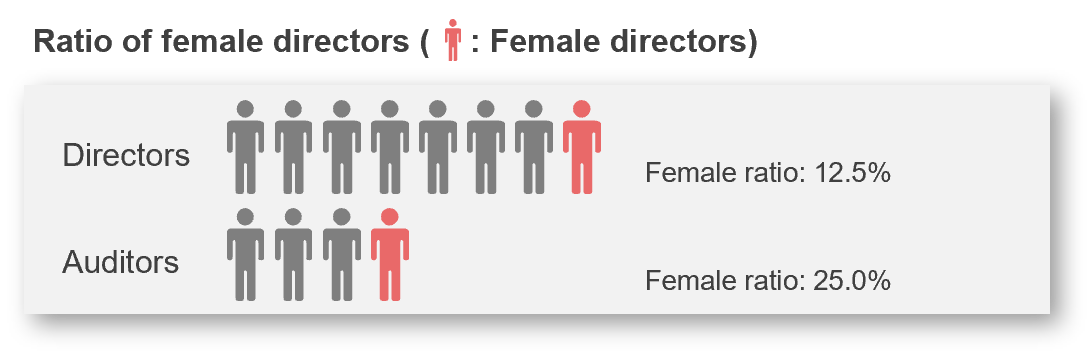

In addition, we have established the Nomination and Remuneration Advisory Committee, which aims to enhance the independence of the Board of Directors’ functions as well as its objectivity and accountability concerning matters such as the appointment, removal, and remunerations of senior management members (a voluntary advisory committee consisting of at least three members, a majority of whom are independent outside directors). Furthermore, a restricted stock compensation plan has been introduced with the aim of sharing profits with our shareholders and improving corporate value over a long period of time. In this way, we are committed to enhancing and improving corporate governance. The percentage of outside directors and women among directors and auditors are as shown below.

|

|

Our view on the appointment of directors

Regarding the appointment of senior management members and the nomination of director candidates, we examine the candidate from various aspects, including diverse experience, knowledge, and competence suitable for promoting further enhancement of the corporate value of the Mitsuboshi Belting Group, as well as qualities such as broad perspective and the ability to take action and lead. Our view on the structure of the Board of Directors and selection criteria are as follows:

Our approach regarding the structure of the Board of Directors

- The diversity of the Board of Directors will be considered in the appointment of directors.

- In order to fulfill its fiduciary responsibility as a whole, the Board of Directors will strive to ensure that the various knowledge, experience, abilities, insight, and expertise of each member supplement its overall functions, thereby enabling the Board to demonstrate its functions (particularly the function to oversee business management) efficiently and effectively.

Criteria for appointment and dismissal of directors

Criteria for appointment of directors

- Is excellent in terms of personality, knowledge, and insight, and has a strong law-abiding spirit and ethical view

- Possesses the ability to make objective decisions as well as insight, and foresight

- Holds sufficient experience and expertise to meet the expectations of stakeholders (including shareholders, customers, employees, and local communities) and to contribute to improving the corporate value of the Group over the medium to long term

- Is able to make fair judgments from a company-wide, neutral perspective and to demonstrate risk management skills

- Has time to make efforts required to appropriately fulfill his/her duties, responsibilities, and roles as a director, and be in a state of health that allows him/her to fulfill such duties, responsibilities, and roles

- Does not fall under any of the grounds for disqualification of a director as stipulated by the Companies Act

- Has had no involvement with anti-social forces in the past and present

- Requirements for independent outside directors

- Possesses a high level of insight, extensive practical experience, and experience in leadership roles, in areas such as corporate management, international business, financial affairs and accounting, banking and finance, regulatory compliance, legal affairs, public administration, academic studies and research, risk management, human resource development and education, and IT and digital

- Has abilities such as understanding the entire Group from a bird’s-eye view and grasping essential issues and risks, and can be expected to contribute to frank, active, and constructive deliberations at meetings of the Board of Directors and other occasions

- Is capable of objectively supervising and making decisions on business management, and providing advice and support for the company's sustainable growth from the practical perspective based on his/her extensive experience in corporate management and specialized fields

- Meets the requirements for outside directors under Japan’s Companies Act and the independence standard set by the Tokyo Stock Exchange

- Requirements for representative directors and executive officers

- Is conversant with industry trends and related regulations surrounding the Group as well as the Group's business model, and possesses a wealth of practical experience in his/her respective specialized fields

- Holds a company-wide perspective and organizational management skills, and is able to execute relevant duties

Criteria for dismissal of directors

- An event has occurred, which reveals that the director has obviously failed to meet the above “Criteria for appoint of directors.”

- A serious fact, such as misconduct or a violation of law, the article of incorporation, or resolutions of a general shareholders’ meeting, has come to surface.

- It is acknowledged that the director has undermined the Group’s credibility or has hindered the smooth operation of the Group’s business for reasons such as the discovery of a scandal or damage for which he/she is responsible.

Skill matrix table for directors (a list of knowledge, experience, abilities, etc.)

| Business administration | Personnel, general, and legal affairs | Finance and accounting |

ESG and sustainability |

Technology and innovation | Purchasing and production | Sales and marketing |

Global experience | |

| President Hiroshi Ikeda |

○ | ○ | ○ | ○ | ○ | |||

| Director Masayoshi Nakajima |

○ | ○ | ○ | |||||

| Director Toshimi Kumazaki |

○ | ○ | ○ | ○ | ○ | |||

| Director Keiji Mataba |

○ | ○ | ○ | ○ | ||||

| Director Shinji Kuramoto |

○ | ○ | ○ | ○ | ||||

| Director Ryuzo Miyao* |

○ | ○ | ○ | |||||

| Director Shinya Okuda* |

○ | ○ | ○ | ○ | ||||

| Director Yuka Miyake* |

○ | ○ | ○ |

Succession planning (President and Directors)

Appointment of senior management members and nomination of director candidates

Policy:

- In light of “improvement of economic value (the ability to generate future cash)” and “pursuit for social value (justification for our existence and mission in society),”

- we have defined our stance as a corporation, such as view and direction, in our Management Policy and management strategies (including medium-term management plans, target position, and business risks), and based on this,

- candidates will be comprehensively examined from a “right person, right place” perspective. Information taken into account in the selection process includes Our approach regarding the structure of the Board of Directors (including diversity) and the Criteria for appointment and dismissal of directors (requirements that are common and that are specific to Independent Outside Directors, and the President and Executive Officers). In addition to these two, which were deliberated on, defined, and resolved by the Nomination and Remuneration Advisory Committee and the Board of Directors, the “skills by category in the skill matrix table of Directors” and “succession plans for the President and Directors” (a pool of candidates in normal times)” will also be considered.

A proposal developed in the above process will be submitted to the Nomination and Remuneration Advisory Committee, which was established with the aim of strengthening the independence, objectivity, and accountability of the Board of Directors' functions concerning matters such as “appointment and removal of senior management members” and “nomination of Director candidates'' (a voluntary advisory committee consisting of three or more members (five members since June 2022), a majority of whom are Independent Outside Directors (three members since June 2022). Based on the recommendation of the committee, the Board of Directors will make a resolution.

- Regarding the 2023 Succession Plan - Normal Time (Process Schedule), the Nomination and Remuneration Advisory Committee deliberated on it, made a decision, and submitted its recommendation (resolution) to the Board of Directors. Based on this, the Plan is implemented (including selecting candidates for next President and Directors with the use of a pool of candidates and other means).

- With regard to the Succession Plan - Emergencies (personnel who will provisionally fulfill the President’s duties and their order), the Nomination and Remuneration Advisory Committee also has deliberated on it, made a decision, and submitted a recommendation (resolution) to the Board of Directors.

Operation status of the Board of Directors (FY2022)

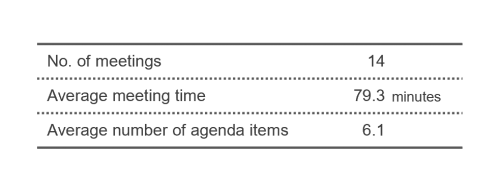

In accordance with relevant laws, the articles of incorporations, and the regulations for the Board of Directors, the Board members deliberate on and resolve matters related to our basic management policy and investments, and other matters such as the execution of important business operations (including disposal and transfer of important assets, borrowing in large amounts, establishment and change of organizations, and appointment and dismissal of important employees). The Board also reports on the status of Directors' execution of duties as well as the status of other important business operations.

In FY2022, in addition to regular agenda items (matters for resolution and reporting), the Board of Directors reviewed the Group’s medium-term management plan and discussed matters related to corporate governance (such as appointment and dismissal of Directors and succession planning of the President and Directors), investments (related to production, logistics, and businesses), and sustainability (including the development of Materiality concerning ESG challenges, the review of the Group Code of Conduct, and CSR activities).

Regarding the operation of the Board of Directors, briefing sessions for Outside Directors are held prior to Board meetings in order to ensure the effectiveness of the Board, and adequate deliberation and discussion within the limited time available.

| Period | Main agenda items (excerpt) |

|---|---|

| First half of the year |

|

| Second half of the year |

|

Operation status of the Nomination and Remuneration Advisory Committee (FY2022)

We have established the Nomination and Remuneration Advisory Committee as a voluntary system (consisting of at least three members, a majority of whom are Independent Outside Directors) with the aim of enhancing the independence, objectivity, and accountability of the Board of Directors concerning matters such as the appointment, removal, and remuneration of senior management members.

The Committee deliberates and make decisions (in response to inquiries by the Board of Directors) on matters such as policies and procedures related to the nomination of director candidates, the appointment and dismissal of senior management members, and the determination of Directors’ remunerations, as well as succession planning (for normal times and emergencies) for the President and Directors.

In FY2022, the Committee discussed each of the above matters, made decisions, submitted recommendations to the Board of Directors.